【Online Casino ohne deutsche Lizenz Bonus ohne Einzahlung】What's Next for Bitcoin? Binance CEO Shares Market Prediction

Disclaimer: The opinions expressed by our writers are their own and do not represent the views of U.Today. The financial and market information provided on U.Today is intended for informational purposes only. U.Today is not liable for any financial losses incurred while trading cryptocurrencies. Conduct your own research by contacting financial experts before making any investment decisions. We believe that all content is accurate as of the date of publication, but certain offers mentioned may no longer be available.

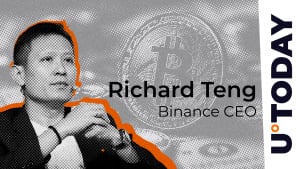

Binance CEO Richard Teng recently tweeted a prediction about Bitcoin, the first and largest cryptocurrency by market capitalization. Teng anticipates "upward momentum" for Bitcoin, urging both countries and corporations to act now or "risk paying a premium later."

AdvertisementIn a tweet posted to his official X account, Teng stated, "Countries and corporations that buy Bitcoin early will benefit from the upward momentum. Those who delay adoption risk paying a premium later."

Countries and corporations that buy #Bitcoin early will benefit from the upward momentum.

— Richard Teng (@_RichardTeng) April 15, 2025

Those who delay adoption risk paying a premium later.

Teng's comments come at a time when Bitcoin is gaining traction, with rising institutional demand and growing interest from sovereign wealth funds and nation-states. However, recently, the Bitcoin price has been largely weighed down by macroeconomic concerns, dropping nearly 21% from its all-time high of $109,114 attained in January this year.

AdvertisementRelated  Wed, 03/26/2025 - 10:33 Binance CEO Exposes Popular Crypto Misconception — Here's Reason

Wed, 03/26/2025 - 10:33 Binance CEO Exposes Popular Crypto Misconception — Here's Reason  Tomiwabold Olajide

Tomiwabold Olajide

Teng's tweet serves not only as a market prediction but also as a warning: early movers stand to gain the most, while those who delay may risk buying at a much higher cost.

Institutional interest continues to grow

As previously reported by UToday, Bitwise data shows that corporations currently own about 688,000 Bitcoins, or 3.28% of BTC's total supply, which is capped at 21 million coins.

Related  Fri, 03/07/2025 - 12:28 Binance CEO Makes Important Bitcoin Statement, Likening BTC to Treasure

Fri, 03/07/2025 - 12:28 Binance CEO Makes Important Bitcoin Statement, Likening BTC to Treasure  Yuri Molchan

Yuri Molchan

Strategy remains the clear leader, outperforming other major corporations by a substantial margin.

Last week, Michael Saylor's Strategy purchased an additional $285.8 million in Bitcoin. From April 7 to April 13, Strategy purchased 3,459 Bitcoin at an average price of around $82,618. According to Bloomberg data, the corporation spent $7.79 billion on Bitcoin in the first quarter. Strategy reported nine purchases in the same period.

At press time, Bitcoin was up 0.71% in the last 24 hours to $85,816.

- https://u.today/sites/default/files/styles/736/public/2024-09/52116.jpg" alt="Tron (TRX) Price Is Bullish, But There's a Catch

All eyes on TRX this weekend Advertis .

Reply - https://u.today/sites/default/files/styles/736/public/2025-04/s6818.jpg" alt="Just 964,247 SHIB: Shiba Inu Burn Rate Crashes to Rare Lows

Shiba Inu (SHIB) currently on breakout watch .

Reply - https://u.today/sites/default/files/styles/736/public/2025-04/57606.jpg" alt="$150,361,090 XRP Mystery Stuns Community, Here's What's Really Behind It

New $150 million XRP transfer not what it seems .

Reply

Jalla Jackpot är här!En rolig nyhet för dig som drömmer om att vinna stort är att du nu får chansen .

Reply